Kinum along with Bryan Pereyo and his colleague constructed a group of top-tier business, medical, and technology consultants who brainstorm ideas to increase efficiency and cash flow for small to large businesses, delivering solutions that allow clients to focus on their specialty instead of worrisome cash flow issues. Our team has revitalized businesses across the country with its customer-building knowledge and pioneering approach combining industry-changing products and services, including account receivables management and flat-rate collections through Kinum.

Bryan is a successful and driven sales and marketing specialist with brand and customer-building expertise and has over twenty years’ experience in developing and leading high-performance sales teams. He understands the customer mindset and the financial drivers that generate revenue.

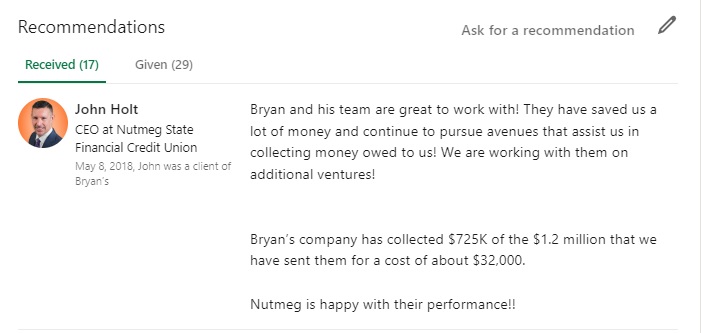

Bryan’s forte is as an esteemed profit recovery specialist. He owns a franchise of Kinum, a “smarter” debt-collection agency, with its proven flat-rate, diplomatic collections process. Bryan is responsible for recovering millions in receivables.

Bryan’s forte is as an esteemed profit recovery specialist. He owns a franchise of Kinum, a “smarter” debt-collection agency, with its proven flat-rate, diplomatic collections process. Bryan is responsible for recovering millions in receivables.

Last year, Kinum had launched a secure online orders website using which clients can engage Kinum to work on their Accounts Receivable. We have also integrated with several billing platforms like AthenaHealth for medical debt collection needs. Using these billing platform integrations, medical professionals can directly transfer their past-due accounts from their Athena interface to Kinum for collections while being in complete control of which accounts are forwarded to Kinum for professional debt recovery.

Kinum also has an excellent track record with dental collections. We have also developed utilities for popular dental practice management software platforms like Dentrix and Eaglesoft. Sachin will carefully understand client requirements and recommend which service to utilize based on account balance and age of the debt. Kinum also has a dedicated commercial collection division, which has been serving B2B debts for quite some time and is a highly rated collection agency based on Google Reviews.

Simple Solutions to manage your Accounts Receivables Management.

Slow payers and delinquent accounts have a severe impact on cash flow. Kinum offers 4 steps (or stages) of debt recovery services, Sachin ensures that his clients completely understand all these 4 steps and clients select only those products which are best suited for them. Clients do not necessarily have to enroll in all 4 steps, instead we can mutually discuss and select which combination works best for each client based on their business type, budget and the age of these accounts. Sachin strongly recommends early intervention of delinquent accounts through Kinum for maximum success. Prompt intervention assists in preserving relationship with these non-paying individuals / businesses.

Kinum offers services for professional services, hospitality, healthcare, health clubs, utilities, education, retail, dental and commercial collections. Collecting debt can be an expensive distraction in busy industries like a healthcare practice. Kinum’s third party collection services take the pressure off office staff, minimize in-house collection costs, and allow healthcare professionals to focus on what they do best- taking care of their patients.

Our goal is to reconnect you with your defaulters before moving to collections (Step 3)

| Opportunity to Reconnect and Revive Relationship | End Relationship | |

| Connect Step 1 (All contacts made under your business name) |

Connect Step 2 (Diplomatic third party demands by Kinum) |

Collect Step 3 (Contingency collections only when necessary) |

| Best used on accounts 30-60 days past due (You control the process) | Best used on accounts 60-180 days past due (You control the process) | Best used on accounts over 180 days past due (process controlled by Kinum) |

| Flat Fee No Matter Balance Size | Flat Fee No Matter the Balance Size | A percentage is charged on any money collected. |

| Defaulters are instructed to pay you directly | Defaulters are instructed to pay you directly | Defaulters are instructed to pay Kinum directly. If defaulter pays you directly, you are obligated to inform and pay Kinum the full contracted percentage of the payment. |

| All contacts tell the defaulter to pay you. | No payments are to be sent to Kinum. All contacts tell the defaulter to pay you. If any money is sent to Kinum, it is forwarded to you. | Kinum accepts payments and puts them into a trust account and will send you the contracted percentage the following month. |

| You control the process to place, pause or cancel accounts at any time in this step. | You control the process to place, pause or cancel accounts at any time in this step. | Kinum controls the process to pause or cancel accounts at any time in this step. |

| Defaulters are told to contact you in this step. | Defaulters are told to contact you in this step. | You should no longer talk to defaulters. All defaulters in this step should be referred back to Kinum at 888-281-1750 |

| All Steps Include the following Scrubs for best results and protection of our clients: Address Scrub • Bankruptcy Scrub • Litigious Defaulter Scrub • Credit Reporting if requested |

||

| Step 4: (Filing a Legal Suit): Kinum may recommend taking matter for legal action by a specialized debt collection attorney if certain conditions are met. |

||

|

|

||

| Name | Bryan R. Pereyo |

| Nickname | Uncle Louie |

| bryan.pereyo@kinum.com | |

| Phone | 916-247-4901 or 408-309-8687 |

| Social | https://www.linkedin.com/in/bryanpereyo @UncleLouiedebt |

| Languages | English & Spanish |

A little about me

Bryan Pereyo is the founder of Sales Antidote, a direct-contract sales company in the healthcare industry. Sales Antidote’s team has revitalized medical practices across the Country, with its pioneering approach that combines industry-changing products and services, including telemedicine (eVisit) and flat-rate collections through Kinum. Bryan is a successful and driven sales and marketing specialist with brand and customer-building expertise, and has over twenty years’ experience in developing and leading high-performance sales teams. He understands the customer mindset and the financial drivers that generate revenue.

Bryan’s forte is as an esteemed profit recovery specialist. He owns a franchise of Kinum, a “smarter” debt-collection agency, with its proven flat-rate, diplomatic collections process. Bryan is responsible for recovering millions in receivables.

Bryan’s forte is as an esteemed profit recovery specialist. He owns a franchise of Kinum, a “smarter” debt-collection agency, with its proven flat-rate, diplomatic collections process. Bryan is responsible for recovering millions in receivables.

He is also Co-Founder of Chronic Focus, an innovative company offering patient engagement programs that promote wellness and healing by engaging patients in a multi-faceted strategy utilizing technology for remote access to health information that is securely captured and interpreted by a portal, which presents the data to the clinical team.

Bryan is active in community and charity organizations. He has coached multiple ASA Gold Softball teams in his home states of Connecticut and New York with many of his kids acquiring college scholarships.

Flat Rate Collections – the Antidote to Boost Cash Flow!

916-247-4901 / bryan.pereyo@kinum.com