Collections can bring on a lot of feelings and emotions. Many times, consumers can have a sense of stress and embarrassment. Stress from possible cash flow problems and embarrassment with the possibility of having to see the client again. Think about it, you have a consumer that you have seen for years, and then all of a sudden, they stop paying you. You send out notices and make calls, but they all go ignored, so you assign it to a collection agency. Then one day out of the blue, you get the call. The patient starts by saying that the collection agency just harassed them. What should you do?

Your Agency Is On Your Side

Knowing that you have an agency that has your best interest is important. When you get a call like the above, you should listen to them and take notes. However, if the bill is still owed, you must refer them back to the agency. If the consumer states that they didn’t have a pleasant experience, have them ask for a manager at the collection agency. At Kinum, we have a strict policy of transferring calls to a manager if asked. This is a critical point in the collection process. You have tried many things to get the consumer to contact you to resolve the debt, and now they are finally calling you.

Realize why they are calling you. No one likes being turned over to a collection agency, and many will try to do anything to get it out of collections. Unless the consumer is paying the balance in full, you should refer them back to your agency. If there is information that needs to be sent to the consumer to resolve the debt, it should be sent by your agency. When an account is in collections, all communications should be from the collection agency so as not to confuse the consumer. You should be able to trust your agency to do the right thing but always verify legitimate concerns that you may have by calling your agency and getting their side.

What if the consumer makes outrageous accusations?

First, don’t jump to conclusions as you will probably receive a very different version of what happened after you speak with your agency. So if this happens, who do you believe? Many times consumers will attempt to create a wedge between you and your agency by making up stories of harassment, but why? You see children do it all the time. The child will ask, “Mom, can I have some ice cream?” When the mom says, “Go ask your father.” The child then says, “Dad, Mom says I can have some ice cream.” In this case, the dad should probably verify the story that the child is telling them, and the same holds true in collections.

What are the facts that you know to be true?

What are the facts that you know to be true? There is a debt that is owed. The patient has not responded to the many invoices sent. They haven’t responded to the numerous calls made. Now they are finally calling you; however, it is not to pay the bill but instead to complain about the agency you hired. By referring them back to the agency, you keep the pressure on them with a unified front and avoid the divide and conquer strategy that is so often used. When you are on the same page as your agency and refer the complaining consumer back, many times, you will see money from them on your next statement. Remember that it is embarrassing for the consumer to tell what really happened because the facts are generally not on their side.

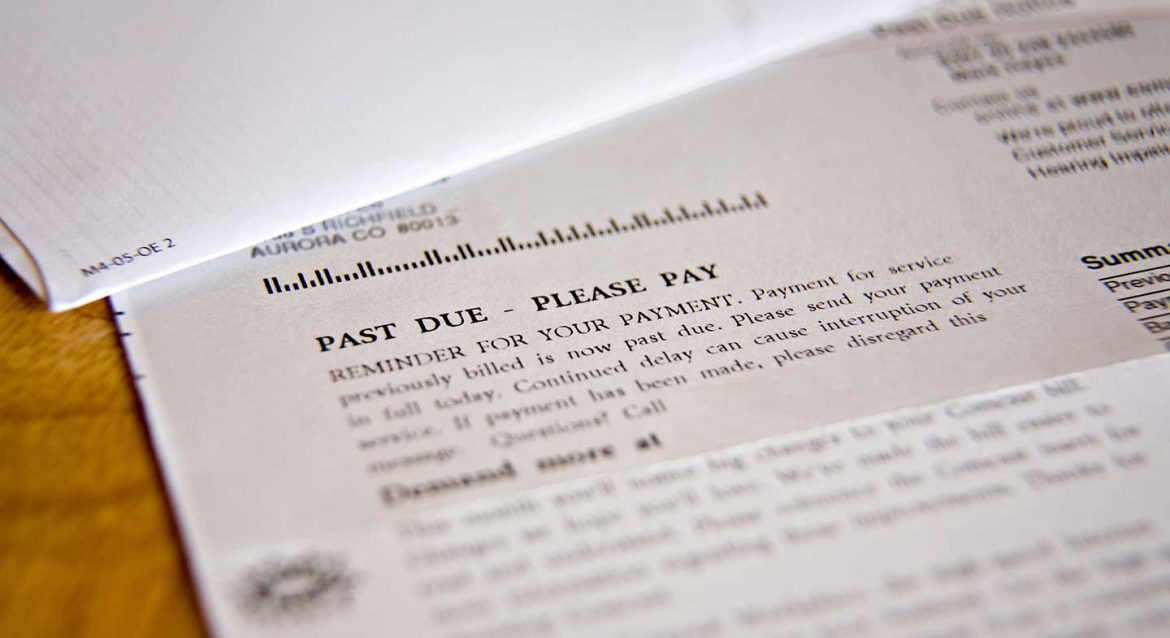

Once we have the consumer’s attention after many unresponsive attempts, we must keep your bill at the forefront to give it the attention that it deserves. Out of sight, out of mind. If the bill isn’t being paid in full upon the first contact, then there must be a concrete arrangement that continues to remind the consumer of the agreement. Collection agencies are required to send out a reminder letter before each payment, and obviously, if there is a concern, we ask the consumer to reach out to us so we can help them get it resolved.

At Kinum, we treat all of those that we come in contact with respect and are professional while collecting your debt legally, morally, and ethically.

To learn more about our Connect and Collect Process, please contact us at (888) 471-0280 today.